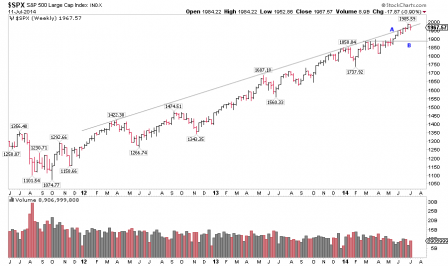

SnP 500

2014-07-14 14:11, Edited at: 2014-07-14 14:14Please note: Community posts are written by its members and not by Redeye’s research department. As a reader you’re always encouraged to critically analyze the content.

Hello mates!

All that I write on my blog is just my personal opinion and nothing more, and should be treated as such.

Some background:

- Banks changed their policy making game and promise to dance more making their decisions.

- Two armed conflicts (Ukraine, Israel), but markets have not reacted with heavy selling.

- FED sends contradictory signals.

- Unemployment, deficit, GDP… you name it.

Having in mind all above and being sure that this is just the tip of the iceberg, we need to make sense what is going on with stock market on the big picture. Let us look on SnP 500. On attached chart it is obvious that index is in uptrend weekly, and daily it shows minor reaction during last week. The reaction brings index in local trading range (marked “TR” on daily chart). Another easy reading is long-term resistance line (marked “A” on chart), and I assure you that ALL who looks at charts watches this line. Drawing this type of lines always tricky (each line maker do it with his (her) own terminal and rules) and we better to watch them as zones. We can see that index dancing around the line for a months it and looks a bit overbought (stays above the line). Nevertheless, I have to say that despite the “A” - line there is no heavy selling from yet (good news for bulls). Also, we have to remember that usually, such a long term up trends do not end at once.

What looks wrong to believe that index resumes up trend? Firstly, it is the same “A” trend line and index dances with it too long already; secondly, last week is the first one from April 2014 that shows new low. Daily up trend lost its momentum too, and in order to resume rally it needs new impulse from buyers.

What should we do, taking into account all above? If you are very careful player, then seat on your hands and wait for more significant reaction, which will reveal how many sellers believe that this is it. Being a bit more aggressive assumes that you look for strong stocks, thus ready to outperform the index.

Is there a window to find a decent short? May be if you are used to have profit from such, just keep in mind that index is in up trend.

Good luck.