Lumito removes the haystack and finds the needle immediately! Market worth 8 billion Usd!

2019-12-02 10:24Please note: Community posts are written by its members and not by Redeye’s research department. As a reader you’re always encouraged to critically analyze the content.

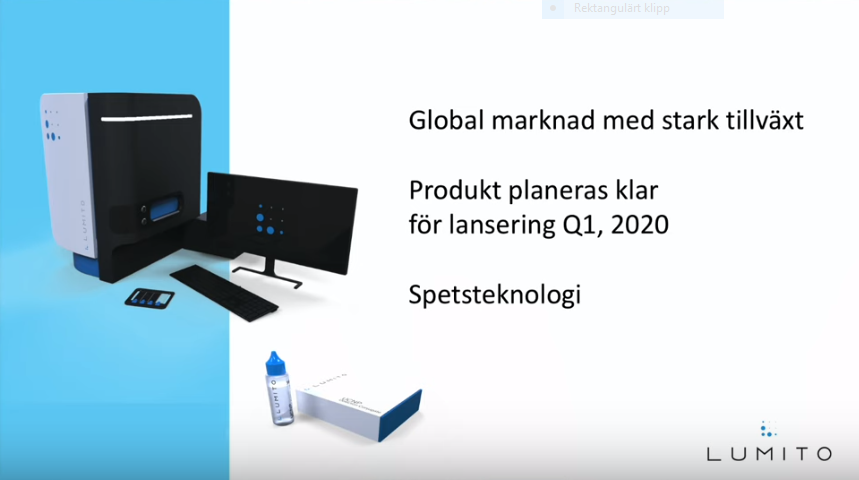

Product launch in 4 weeks!

Lumito removes the haystack and finds the needle immediately! Real upside to successful market launch(Only 4 weeks left.)

1. My thoughts about the company/Video presentation

2. Medicon valley

3. The technique and image explanation

4. Value-building steps recently and up to launch Q1 2020

5. Purchase candidate / Price tag?

6. Safe with stable cash register and to2 redemption

7. Competition situation

8. Insider owners are increasing their holdings

9.The problem of reduced number of pathologists is large and is already being discussed in the Swedish Parliament.

10. Termination words

1. My thoughts about the company/Video Presentation

In this part of my analysis, I only thought about writing a little about my personal thoughts about the company. For a long time I was critical of the company because of their short path to the market and if they really would succeed or if it was just empty promises? That is why I did not dare to buy into the company at an early stage even though I owned the sister company Spectracure since the 2kronors level, I have also taken in Prolight Diagnostics recently as I think this company can be very good in the long term. I have a portfolio that I call the medtech portfolio, which consists of various companies from Medicon valley in Lund. For a long time, I have followed Masoud Khayyami and his various corporate engagements for a long time, as I consider him to be a bit of a super-contractor with fantastic ideas in, among other things, medtech. It was only now in November 2019 that I actually chose to buy a larger share of Lumito shares in my Medtech portfolio, due to the fact that CEO Stefan Nilsson repeats the mantra that one should be ready for Q1 2020 and then be ready to sell the instrument. What I understand now about Lumito is that if they succeed in improving tissue diagnostics from today's 70% accuracy to 99%, this could revolutionize the entire healthcare system to work with tissue diagnostics, insurance companies in the United States will require the lab to have this technology to prevent malfunctions, etc. One should know that Pathology / tissue diagnostics is the last part of healthcare that has not yet been digitized and is therefore facing a paradigm shift. With the latest news and updates from the company, I actually believe that they will succeed in keeping their schedule, most recently on the big stock day which was now in November in Gothenburg, so the CEO repeated that they should be ready Q1 2020 and then start selling their instruments. If they succeed in this, the upside is huge but if they fail in the schedule there is a big downside, but for SEK 5.90 / share at the time of writing (Eg approx. SEK 350 million) then it is a risk / reward I am willing to take. With a price per instrument of about SEK 2 million and current revenue on accessories such as reagents, etc., this company can become cash flow positive already next year. In my opinion, Lumito is the company of Masoud Khayyami's commitment that is closest to a launch or exit but still has not received the real upgrade it deserves, I think the market is awaited until December to see if Lumito succeeds in its plan. Finally, my favorite quote from the CEO is the same as the heading of my analysis "Lumito removes the haystack and finds the needle immediately".

Company presentation: https://www.youtube.com/watch?v=Jn9tXfwvVMU

Link to stock day Nov 4 Gothenburg: https://www.youtube.com/watch?v=QrZVR8KbDyk

2. Medicon valley

Lumito is now part of the medicon valley which is a huge quality stamp. Medicon Valley is a strategically important life sciences development area for both Swedish and Danish authorities. Ambitious strategies are focused on building the cluster by facilitating research and innovation, which has already resulted in several successful partnerships and business successes. An important part of the strategic strategy is to make it very easy for international investors and companies to establish, which increases the value for the cluster and the incoming investor.

Link to website: https://www.mediconvalley.com/

Link to companies that are part of the medicon valley: http://mva.org/membership/latest-members/

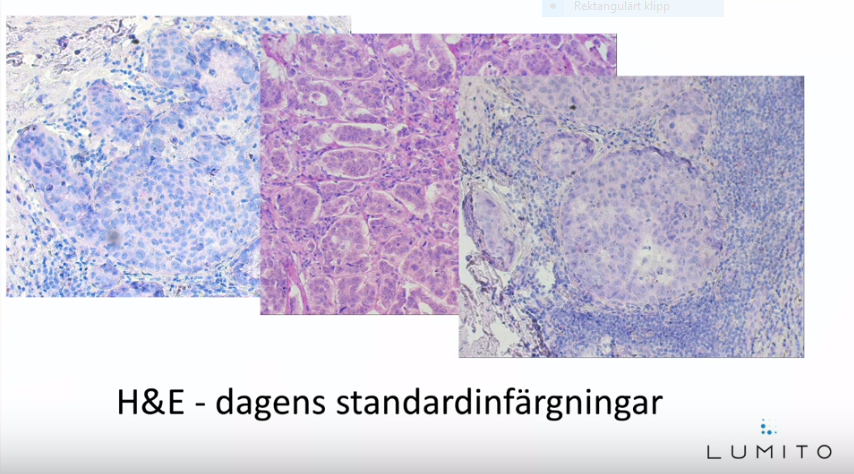

3. The technique and image explanation

Text is copied from www.Lumito.se

"Lumito specializes in medical research on imaging techniques. The techniques, which are based on up-converting nanoparticles ("UCNP"), can be used to create products for imaging of tissues in living organisms (in vivo) as well as in tissue samples in the laboratory environment (in vitro).

Higher image quality, safer diagnoses and faster analysis response

The technology has several potential uses, but in a first step Lumito has chosen to develop an instrument and reagents for digital pathology, ie digitalized tissue diagnostics where the analysis can be computer-supported and done remotely.

Lumito's technology means that it can perform multiple tests simultaneously in a single thin tissue section. This time-efficiently detailed information about the disease. The demands for individualized treatments and prognoses of diseases are growing rapidly, as it reduces the suffering of patients and lowers the costs of healthcare. The need to make a rapid and accurate diagnosis of disease / tumor means high technical requirements for modern analysis equipment and adaptation to changing workflow with fewer manual steps.

Digital pathology is run by the healthcare system to save costs and short test response times. Today's pathology is largely performed in much the same way for several decades by staining with Hematoxylin and Eosin in thin tissue sections. Although every incision is studied by a pathologist, many inaccurate diagnoses are made. Today's immunohistochemistry is very limited as it was developed primarily for traditional pathology where samples are studied under microscope; it must be visible light because the human eye is reading the sample and fluorescence imaging cannot be used. Lumito's technology is much better suited for computer analysis than traditional immunohistochemistry because the image quality is so high. The diagnoses are safer and the answers can be given faster.

The digitization of pathology does give more degrees of freedom, but many problems remain. With Lumito's technology, a large tissue sample can be quickly loaded and only those areas containing the searched tissue can be imaged at higher resolution. This is absolutely crucial for speeding up the digitization process.

A future vision for surgeons and pathologists is to be able to diagnose tissue already on the operating table. Or better yet - before surgery. Lumito's technology has the potential to do this."

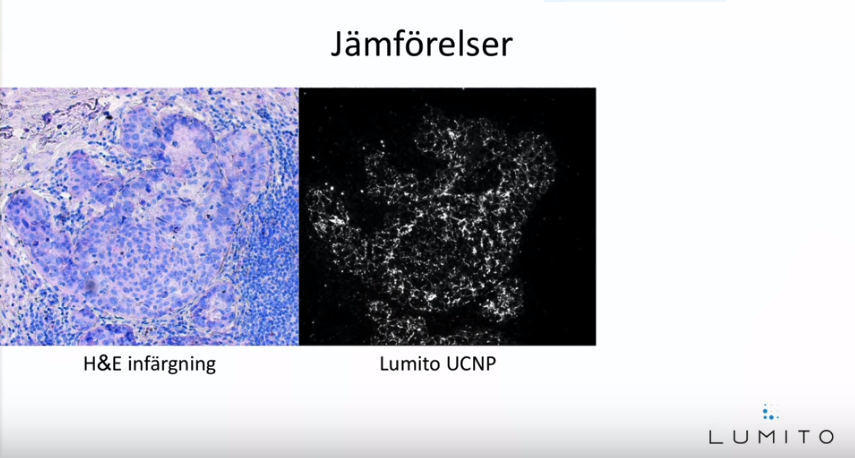

These pictures really show what CEO Stefan Nilsson means when he says that Lumito removes the haystack and finds the needle immediately, which is meant to remove all unnecessary information in the tissue sample so that you only see what you need to see to make a safe diagnosis.

Link to homepage: www.Lumito.se

4. Value-building rose recently and until Q1 2020.

Lumito has performed well lately and is slowly but surely building value for its shareholders. I will make a list below with recent progress the company has presented and also what I think may be presented in the near future.

⦁ Lumito initiates collaboration with RISE

In order to ensure quality and stability in the preparation process of Lumito's staining reagents, Lumito has entered into a collaboration with RISE (Research Institutes of Sweden). The collaboration means that RISE will take over the development results regarding the reagents from Lumito's development partner TTP. RISE will then optimize protocols to ensure a smooth and stable production process.

"As we approach the completion of our first product, it is important to ensure the quality and stability of our reagents.

RISE has the skills and resources required in that process, "says Lumito's CEO Stefan Nilsson.

Link: https://mb.cision.com/Main/17276/2948089/1132307.pdf

From Lumitos pressrelase:

"⦁ Important advances in product development - simultaneous staining of same sections with high degree of detail. Lumito is developing a new method for producing high contrast images with no background signal. The first application is developed for tissue diagnostics and digital pathology. To visualize cells with the presence of Her2, a common marker for breast cancer diagnosis, Lumito is now publishing new images of breast tissue stained with the company's Her2-UCNP reagent. Lumito's technology provides the opportunity to dye tissue with nano-particle-based reagents and thus make imagery in the proprietary instrument. Two of the most important advantages are to obtain images with high contrast and detail, as well as staining with both Lumito's and traditional reagents in the same tissue section. The pictures show comparable degree of detail similar to traditional staining. The advantages of the images with Lumito's technology are that there are only signals from the markers that are being sought - in this case the breast cancer marker Her2. - When studying Her2 imaging based on Lumito's technology, it is easy to understand the potential for pathologists to see only tissue of interest. The technology also offers the potential for image analysis that may be helpful in the future when introducing automated diagnoses, says Stefan Nilsson, CEO of Lumito."

Link: https://mb.cision.com/Main/17276/2930922/1122261.pdf

⦁ Lumito has delivered and tested the alpha prototype (Finwire) Lumito's development partner TTP has now delivered the alpha prototype of what will be the company's first product.

After delivery, the instrument has undergone an internal acceptance test with approved results, says Lumito in a press release.

"It is an important step that we can now work on site with the prototype to get the basis for the development of the beta prototype and that we will now be able to demonstrate the functionality for potential customers and partners in place in Lund," comments Stefan Nilsson, CEO.

Link: https://www.avanza.se/placera/telegram/2019/08/12/lumito-lumito-har-fatt-alfaprototypeenleverlever-and-testad.html

Upcoming value-building steps can not be known directly, but you can guess what the company must get through to be successful with the launch, list below.

⦁ CE marking.

⦁ distribution partners.

⦁ Finished beta product.

⦁ Steps in development phase 3.

⦁ Pre-orders on instruments which will generate revenue for the company.

5. Purchase candidate / Price tag?

The price tag of a company that Lumito may be difficult to say, but assuming they succeed and considering that the market for tissue diagnostics is at SEK 80 billion a year with a growth of 10% / year should be a reasonable bid lie somewhere between 3-10 billion Swedish crona. At full To2 redemption based on 74 million shares, the price can thus, according to my calculations, land on anything between swedish crona 40-135 / share.

Here I choose to quote the analysis guide straight away as I think they expressed this in a good way.

"Acquisition candidate as a result of M&A activity in the medtech sector

Lumito's technology is patented and has the potential to solve a problem that has long been recognized and attempts at action have been made but have not succeeded. Thus, there may be incentives for major players to acquire Lumito's technology and commercialize it via their own channels. Something that speaks extra to this is that Lumito has a product that is soon ready for the market, which reduces the investment need for a potential buyer. "

6. Safe with stable cash register and to2 redemption.

In the latest Q3 Report 2019, it can be seen that cash and bank amounted to SEK 22.0 million as of September 30. Lumito also currently has an ongoing to2 redemption, however, this is done in two redemption periods and will, at full to2 redemption, add approximately SEK 22 million to the company. It can be mentioned that to2 is already deep in the money. With calculations of the recently increased burn rate, you can see that the cash will reach a good bit in full to2 redemptions in 2021. Hopefully, the company is then already cash flow positive and no more NE will be done, CEO Stefan Nilsson has mentioned this at some point .

Link: https://www.avanza.se/placera/pressmeddelanden/2019/10/31/lumito-kvartalsrapport-2019-q3-fran-lumito-ab-publ.html

https://news.cision.com/se/lumito/r/forsta-inlosenperiod-avseende-lumito-teckningsoption-to2-inledd,c2951662

https://www.avanza.se/placera/telegram/2019/11/25/lumito-lumitos-optionspengar-kan-racka-in-i-2021-vid-fullt-utnyttjande-vd.html

7. Competition situation

In order to get a serious analysis, I would like to highlight the competition situation. There are, of course, most actors who want to be part of the digitalisation in pathology and tissue diagnostics. In many places, it has begun to replace the microscope with digital images on the data screen. They have also started with AI (machine learning). However, the common denominator for all competitors is that whatever they do, their technology is based on the old staining system. No one else has the technology that Lumito has in the form of UCNP (up converted nano particles) and this is what gives 99% accuracy in the tissue samples. This is something that is of great benefit to Lumito as their technology and patents are highly sought after by those working with AI. Should you implement Lumito's technology in a well-developed AI, you simply have a home run and then the problem with the pathologic deficiency is solved. A collaboration or acquisition of any major competitor is expected in the near future.

8. Insider owners are increasing their holdings

2019-11-14, the company announced that Lumito's principal owner, CEO and board member exercise all his warrants

Lumito's major owner Cardeon Futuring Finance (40% owned by Masoud Khayyami), Lumito's CEO Stefan Nilsson and board member Ulf Bladin exercise all of their warrants TO2 for subscription of shares in Lumito AB in the first redemption window. This includes a total of 2,130,000 warrants. Stefan Nilsson's total shareholding in private and via companies thereafter amounts to 1,314,643 shares. Cardeon Futuring Finance's total holding after the subscription amounts to 5,000,000 shares. Ulf Bladin has fully subscribed for his TO2 and after subscribing holds 120,000 shares.

This is an incredible message of strength given Masoud, who is already the largest owner of the company in this case, chooses to further invest approximately SEK 1.4 million through his company.

Source: https://mb.cision.com/Main/17276/2961865/1141550.pdf

9.The problem of reduced number of pathologists is large and is already being discussed in the Swedish Parliament.

For effective healthcare of good quality, pathology is a very important process for providing diagnosis and evidence for treatment decisions. The basis may be the factor that contributes with information so that treatment is given in a reasonable time and avoids a continued suffering for the patient.

The number of samples to be analyzed will be doubled until 2030. It is not only the number of referrals that increase, but more tissue samples are taken in more places where each sample must be prepared and analyzed. In addition, more tests are currently being done on each sample. It is a challenge to get the flow working so that no queues occur during the process.

Pathologists are specialist doctors who perform autopsies but mainly analyze body parts and tumors. It has long been and still is a major shortage of pathologists and this has become one of the major bottlenecks in cancer care. In addition, many pathologists will soon retire. It is important to get more people to become a pathologist and therefore more training places are needed.

From the patient's perspective, the time between sampling and when the patient is informed about answers and decisions about continued treatment is an expectation with sometimes great concern. Under no circumstances is having to wait up to three months for a cancer test.

It is necessary to follow up waiting times from both a management / planning perspective and from the individual patient perspective. In a laboratory, several different tasks are carried out by different occupational categories, from biomedical analysts in the laboratory to diagnostic pathologist / cytologist and the tasks of the administrative resources. The fact that the interaction works is important for an efficient flow.

https://www.riksdagen.se/sv/dokument-lagar/dokument/motion/minska-vantetider-for-patologiska-provsvar_H7023291

10. Termination words

Lumito is now extremely close to reaching the market with its product, will they succeed or not? If they succeed, I see here a success story with the potential for huge growth in the coming years. Many instruments sold during 2020 are not required for our shareholders to have a substantial increase in value on our invested capital. If you fail to charm the market with your product, it may take time to get started with sales. But if the technology is as revolutionary as Lumito himself claims, I can only say that the sky is the limit for this company. The risk / reward I think is reasonable right now and the rate has the potential to go over 500% from today's level with only a few sold instruments in 2020. I believe and hope that Lumito will penetrate the market well into 2020, with the right partner this can go very fast .

(Disclaimer: I own shares in the company myself and this should not be seen as any buying advice of any kind. I advise everyone to obtain their own information before choosing to make an investment.)