Moberg Pharma – (toe)nail-biting opportunity for 5-15-fold returns

2020-02-05 14:58Please note: Community posts are written by its members and not by Redeye’s research department. As a reader you’re always encouraged to critically analyze the content.

Moberg Pharma has a potential best-in-class treatment for nail fungus, with an annual sales potential of >10x the current market cap. They have a MCAP of MSEK 360 and partnerships with potential milestones of over MSEK 1000 plus royalties and supply fees.

Moberg has two assets, MOB-015 and BUPI, treatments against nail fungus and pain relief for oral mucositis respectively. I will discuss the first asset only in this post. MOB-015 is in phase III with results from the US reported in December last year and EU is expected in Q2 this year.

Moberg Pharma has a potential best-in-class treatment for nail fungus, with an annual sales potential of >10x the current market cap. They have a MCAP of MSEK 360 and partnerships with potential milestones of over MSEK 1000 plus royalties and supply fees.

I argue that even though there might be risk related to the approval due to the study design, it is 100 % clear that the product works and that it could become the market leading treatment for nail fungus. At that point the company could justify a MCAP of above MSEK 5 000 according to my assumptions.

Mob-015:

The treatment is topical and based on described by Moberg Pharma as “The company’s patented formulation technology facilitates delivery of high concentrations of a proven antifungal substance (terbinafine) into and through the nail, and has emollient and keratolytic properties that contribute to rapid, visible improvement.”

The use of a topical treatment is often preferred, as oral terbinafine can have severe side effects and even death. MOB-015 delivers the terbinafine directly to the affected area and the amount detected in the liver is therefore close to zero.

Study results:

The reason for the decline in the share price after the US study results was that even though they beat the control group and achieved exceptional mycological cure rates the visual appearance of the nail was only 100 % perfect in 4.5 % of the cases.

From a company press release:

“Mycological cure (eradicating the fungal infection) was achieved in 70 percent of the patients, which is substantially higher than reported for other topical treatments (30-54 percent). Furthermore, 83 percent of the patients reported visible nail improvement by the first follow-up visit. However, despite the strong mycological cure and rapid visible improvement, a lower than expected complete cure rate of 4.5 percent (normal looking nails and negative fungal culture) was reached, which was surprising because a high mycological cure is typically followed by clinical cure and the combined endpoint complete cure.”

After further evaluations by independent experts it seems like the nail-penetrating properties of the treatment gives the nail a slight temporary white look.

The patients themselves reported this:

“33 percent reported that their treated toenails were completely cured or almost cured. In addition, 83 percent of the patients reported a visible improvement after just twelve weeks of treatment.”

Summary: The treatment works better than other available treatments, but that there might be a need to shorten the treatment time or just be patient and allow time for the white hue to disappear.

Approval:

The US launch is dependent on two phase III studies providing positive results, while the EU launch is dependent on the treatment showing non-inferiority compared to a control group using a treatment that would be expected to show 3-8 % complete (visual) cure, but much lower eradication of the fungal infection.

But in both studies, it is the visual inspection that is the primary endpoint, so there could be challenges in getting a marketing approval. In such an event the company would have to raise money and the launch would be postponed. Importantly though, the best-in-class market position of the treatment 2-3 years ahead would still be likely in my opinion.

The Canadian, South Korean and importantly the Japanese launch are not dependent on the EMA and FDA interpretations though. The Japanese approval needs a separate study which their partner Taisho will fund in its entirety.

Valuation:

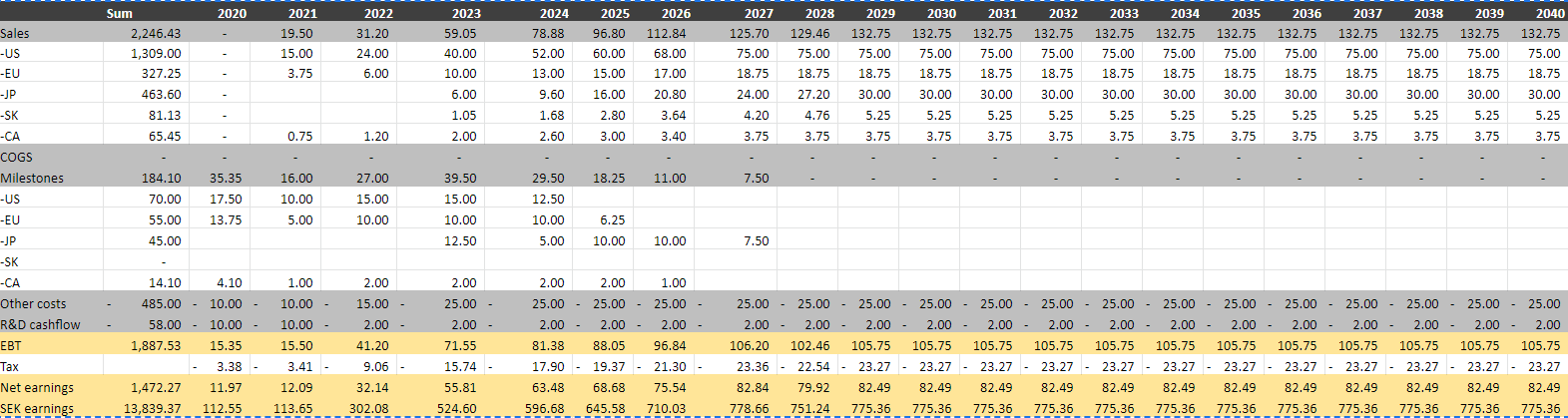

In a “blue sky” scenario I assume that both FDA and EMA will approve the treatment and that sales will start in 2021 in the US, EU and Canada, while Japan and South Korea will launch in 2023. I assume MUSD 525 peak sales and a WACC of 8 %. There are no inflation or market growth in my simple model, so that is why the sales are slightly above the high end of the company’s estimates and the WACC so low. COGS are set to zero as most partners will pay for supplies, and I have assumed 25 % royalties in all countries except South Korea (35%).

In the US I have assumed a partnership paying 70 MUSD in milestones and 25 % royalties. I have not assumed that Moberg will distribute the product themselves, although that is their plan and it would probably make a substantial positive contribution to the valuation.

Using this input, I get an NPV of around 307 per share.

Assuming only an EU and Canadian launch in 2021 and additional studies to get a US approval I arrive at an NPV of 109 per share and the need to raise capital, either through a share issue or a BUPI partnership.

Remember that assumptions are only a best guess on my part, and that many things can happen.

Potential surprises:

· Bid from Bayer, who entered the MEUR 50 + royalties and supply fees deal in Europe. If they believe in MOB-015 they could buy the company to save the partnership costs and get the global potential for free if they offered around 80 SEK per share.